3reich.ru

Learn

Lenders That Use Vantagescore

Moving from the current Classic FICO credit score model to require lenders to use FHFA announces validation of FICO 10T and VantageScore for use by Fannie. Not necessarily true. Synchrony is one of the few known lenders who use Vantage scoring for credit-granting purposes. Most top 10 US banks, large credit unions and leading fin-techs use VantageScore credit scores in one or more lines of business including credit cards, auto. Mortgage lenders are the biggest user of a FICO score, while most credit monitoring services use a Vantage score. Lenders use these scores to assess the. Understand the difference between VantageScore and FICO, and learn how to locate a mortgage lender that uses VantageScore for credit reporting. FICO claims its scores are used by 90% of top lenders. VantageScore: Founded in by Equifax, Experian and TransUnion. The company uses several different. Understand the difference between VantageScore and FICO, and learn how to locate a mortgage lender that uses VantageScore for credit reporting. Eight of the top 10 banks, and 30 of the top 50 banks use VantageScore credit scores. Usage of VantageScore is widespread across loan types however the top More than 3, institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages. Moving from the current Classic FICO credit score model to require lenders to use FHFA announces validation of FICO 10T and VantageScore for use by Fannie. Not necessarily true. Synchrony is one of the few known lenders who use Vantage scoring for credit-granting purposes. Most top 10 US banks, large credit unions and leading fin-techs use VantageScore credit scores in one or more lines of business including credit cards, auto. Mortgage lenders are the biggest user of a FICO score, while most credit monitoring services use a Vantage score. Lenders use these scores to assess the. Understand the difference between VantageScore and FICO, and learn how to locate a mortgage lender that uses VantageScore for credit reporting. FICO claims its scores are used by 90% of top lenders. VantageScore: Founded in by Equifax, Experian and TransUnion. The company uses several different. Understand the difference between VantageScore and FICO, and learn how to locate a mortgage lender that uses VantageScore for credit reporting. Eight of the top 10 banks, and 30 of the top 50 banks use VantageScore credit scores. Usage of VantageScore is widespread across loan types however the top More than 3, institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages.

We take time to find common ground to support an agenda that serves consumers, lenders, and the financial market as a whole. mortgage companies that use vantage score my vantage score is higher than my fico and i am planning to refi my mortgage. Who uses the vantage score? Hi. Most top 10 US banks, large credit unions and leading fin-techs use VantageScore credit scores in one or more lines of business including credit cards, auto. Recently, the Federal Housing Finance Agency (FHFA) approved the use of VantageScore for lenders who sell loans to Fannie Mae or Freddie Mac (Government. Recently, the Federal Housing Finance Agency (FHFA) approved the use of VantageScore for lenders who sell loans to Fannie Mae or Freddie Mac (Government. More than 3, institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages. FICO claims its scores are used by 90% of top lenders. VantageScore: Founded in by Equifax, Experian and TransUnion. The company uses several different. FICO is used by lenders to determine credit risk with 90% of top lenders. VantageScore is used by lenders too but is not as widespread. Who Uses VantageScore? Because VantageScore offers predictive performance lift across all credit industries, lenders prefer our credit scoring model. mortgage companies that use vantage score my vantage score is higher than my fico and i am planning to refi my mortgage. Who uses the vantage score? Hi. Eight of the top 10 banks, and 30 of the top 50 banks use VantageScore credit scores. Usage of VantageScore is widespread across loan types however the top Mortgage companies will use FICO over vantage because the Automated Underwriting Systems read the FICO report. Some lenders may use Vantage, but. used by mortgage lenders VantageScore , for use by the Enterprises. Once implemented, lenders will be required to deliver both FICO 10T and VantageScore. VantageScore rates the credit of individuals and gives them a score between and It is an acceptable alternative to the Fair Isaac Corporation's FICO. Who Uses VantageScore? Because VantageScore offers predictive performance lift across all credit industries, lenders prefer our credit scoring model. Depending on which model, or even which credit bureau furnishes the information used in calculations, your credit scores may vary. Lenders and creditors may use. VantageScore, a leading national credit scoring company, announced today that the U.S. Veterans Administration accepts mortgage loans using the. Which mortgage providers use VantageScore? Lenders that issue Fannie Mae and Freddie Mac-funded mortgages, which make up the vast majority of residential. There are different credit scoring models which may be used by lenders and insurers. Your lender may not use VantageScore , so don't be surprised if your. VantageScore® has yet to be widely adopted by lenders, which is why your FICO® Score will carry the most weight when you apply for a mortgage. However, lending.

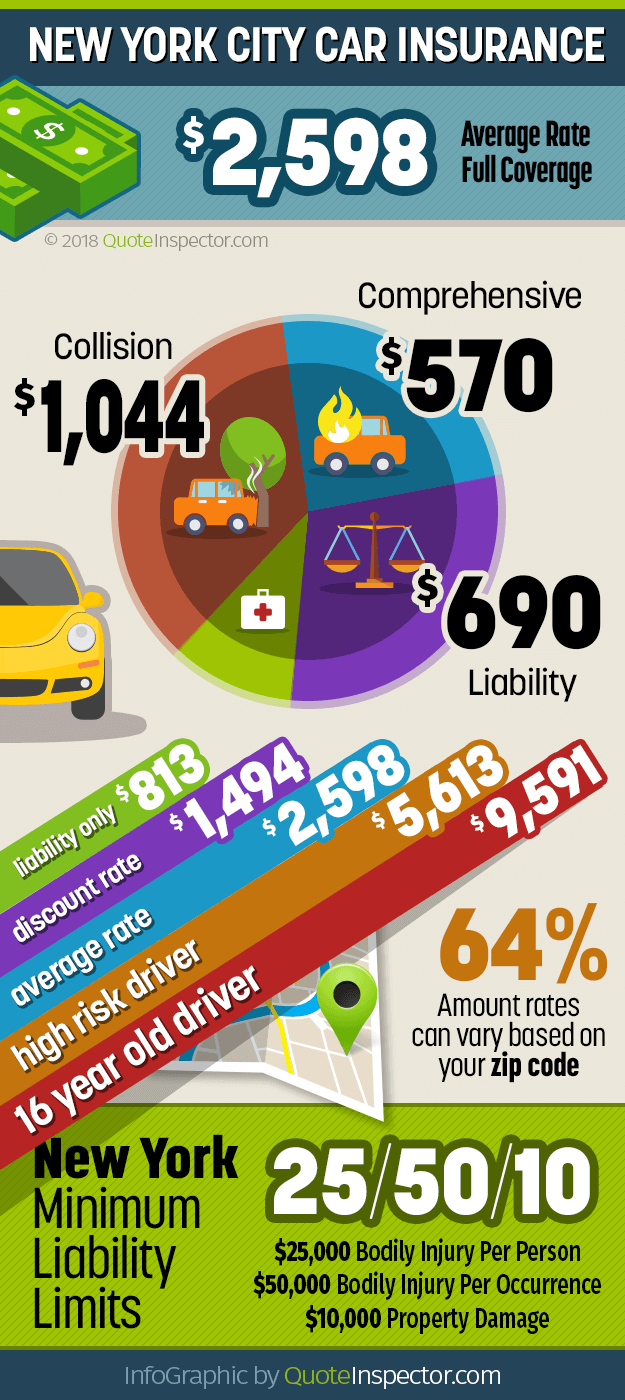

Whats The Cheapest Car Insurance In Ny

Cheapest Car Insurance in New York ; 1, NYCM Insurance, $ per month ; 2, Main Street America, $ per month ; 3, Geico, $ per month ; 4, Progressive, $ To discover the best car insurance in New York, visit: · 3reich.ru · This platform offers a comprehensive selection of top-tier. Cheapest car insurance in New York for drivers with prior accidents ; Utica National. $1, $5, ; Utica National. $1, $5, ; Progressive. $1, $2, NYCM Insurance has the cheapest car insurance premiums for drivers in New York City. Learn more about driving in New York, NY. New York drivers can get a free car insurance quote in just a few clicks. Learn about state-required coverages & available discounts from Allstate. We found that Progressive offers the cheapest annual rate at $1, in New York. The most expensive annual auto insurance rates are for Chubb which is $6, To get the lowest car insurance, compare quotes from multiple insurers The cheapest insurance in NYC is usually Geico. Upvote 7. Downvote. The cheapest insurance in NYC is usually Geico. Based on MoneyGeek's research, the company offering the cheapest car insurance in New York is Kemper, with an average cost of $ per year for minimum. Cheapest Car Insurance in New York ; 1, NYCM Insurance, $ per month ; 2, Main Street America, $ per month ; 3, Geico, $ per month ; 4, Progressive, $ To discover the best car insurance in New York, visit: · 3reich.ru · This platform offers a comprehensive selection of top-tier. Cheapest car insurance in New York for drivers with prior accidents ; Utica National. $1, $5, ; Utica National. $1, $5, ; Progressive. $1, $2, NYCM Insurance has the cheapest car insurance premiums for drivers in New York City. Learn more about driving in New York, NY. New York drivers can get a free car insurance quote in just a few clicks. Learn about state-required coverages & available discounts from Allstate. We found that Progressive offers the cheapest annual rate at $1, in New York. The most expensive annual auto insurance rates are for Chubb which is $6, To get the lowest car insurance, compare quotes from multiple insurers The cheapest insurance in NYC is usually Geico. Upvote 7. Downvote. The cheapest insurance in NYC is usually Geico. Based on MoneyGeek's research, the company offering the cheapest car insurance in New York is Kemper, with an average cost of $ per year for minimum.

The average cost of car insurance in New York is $ per month, which exceeds the national average of $ On average, New York's minimum car insurance requirements cost drivers around$ per month or $ per year. Full coverage insurance typically costs an average. What is the best car insurance in New York? · Allstate customers who switch and save with Progressive save $ on average · GEICO customers who switch and save. Most importantly, maintaining a good driving record will save you more by allowing you to qualify for the best rate. Your final auto insurance premium will be. Progressive and New York Central Mutual Fire have the overall cheapest car insurance in New York for good drivers, based on the companies in our analysis. The. Discover affordable New York car insurance from The General. Start your New York auto insurance quote and receive a commitment-free estimate today. The best cheap car insurance companies in New York are American Kemper, Progressive, Main Street America, NYCM, and GEICO — though rates will depend on your. Progressive is the cheapest car insurance company in New York for a driver with a clean record. According to our analysis of rates, the average rate for a good. Buffalo Auto Insurance Costs by Insurer · Geico: $ · Progressive: $ · NYCM Insurance: $ · Allstate: $ · State Farm: $ Buffalo Auto. The cheapest car insurance companies in New York City National Grange Mutual, the flagship company of Main Street America Insurance, offers the lowest rates. What is the cheapest car insurance in New York? According to our research, Progressive offered the cheapest average rates for car insurance in New York. Progressive is the cheapest car insurance company in New York overall, with an average rate of $47 per month for minimum coverage and $ per month for full. According to our research, State Farm provides the cheapest full coverage auto insurance in New York with average monthly premiums of $ Close second and. CSAA offers the cheapest car insurance in New York, with a rate of $ per month for liability coverage. With a liability insurance rate of $, Safeco is the. The cheapest car insurance companies are USAA, Nationwide and Travelers according to Forbes Advisor's analysis. Learn more about cheap car insurance. New York Central Mutual offered the cheapest full insurance coverage in New York at $/mo. See the other cheapest full coverage insurance companies and best. The cheapest car insurance companies in New York City National Grange Mutual, the flagship company of Main Street America Insurance, offers the lowest rates. Among the five companies analyzed, Geico is the cheapest auto insurance policy option for new driver car insurance in New York, on average cost. Teen drivers. Coverage Cat found that Progressive has the best cheap car insurance, with premiums of approximately $ per month. Key takeaways · The average cost of car insurance in New York per month is $ for minimum coverage, while full coverage costs an average of $ a month.

Which Is The Best Bank To Take Home Loan

Known for its streamlined mortgage process, Rocket is among the best online mortgage lenders. It placed first in mortgage servicer satisfaction and second in. Our quick rate calculator will find the best loan option for you. Simply share some details about yourself and your property. Ready to Apply? We'll help you. Best mortgage lenders · Bethpage Federal Credit Union · Veterans United Home Loans · Cardinal Financial · First Mortgage Direct · New American Funding · USAA · U.S. Perfect if you're looking to buy a single-family home, owner-occupied primary residence, second home, or investment property. Apply Now. The Basics. No income. loan. It's a good idea to apply for mortgage preapproval from at least three lenders. With a preapproval, the lenders verify some of the details of your. State Street Bank offers mortgages at great rates. Learn more about the Our mortgage experts will take the time to help you through the home loan process and. What Are the Best Mortgage Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans. Best Mortgage Lenders for August · Best Overall, Best for Customer Experience, Best for First-Time Homebuyers: Rocket Mortgage · Also Good for Customer. Generally speaking for speedy processing of housing loan proposals in Chennai you can approach HDFC bank, LIC Housing Finance, KMB, YES bank. Known for its streamlined mortgage process, Rocket is among the best online mortgage lenders. It placed first in mortgage servicer satisfaction and second in. Our quick rate calculator will find the best loan option for you. Simply share some details about yourself and your property. Ready to Apply? We'll help you. Best mortgage lenders · Bethpage Federal Credit Union · Veterans United Home Loans · Cardinal Financial · First Mortgage Direct · New American Funding · USAA · U.S. Perfect if you're looking to buy a single-family home, owner-occupied primary residence, second home, or investment property. Apply Now. The Basics. No income. loan. It's a good idea to apply for mortgage preapproval from at least three lenders. With a preapproval, the lenders verify some of the details of your. State Street Bank offers mortgages at great rates. Learn more about the Our mortgage experts will take the time to help you through the home loan process and. What Are the Best Mortgage Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans. Best Mortgage Lenders for August · Best Overall, Best for Customer Experience, Best for First-Time Homebuyers: Rocket Mortgage · Also Good for Customer. Generally speaking for speedy processing of housing loan proposals in Chennai you can approach HDFC bank, LIC Housing Finance, KMB, YES bank.

Home Mortgage Loans. Fifth Third Bank can help you get moving with great rates and a variety of mortgage lending products to fit your needs. Apply Online. Get. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. All requests for a lower rate must occur at least seven (7) calendar days before closing. ↵. 4. Navy Federal Credit Union was included in 9 Best VA Lenders in. Up to % financing is available, with flexible credit guidelines. Income limits may apply. Federal Housing Administration. FHA loans can be a good fit for. Go to a local lender from a local mortgage company; local lenders are the best. Shop around with other local lenders as well. Good luck! Proud To Help You Find the Best Loan Type For Your Future. At The Federal apply to you individual situation. Gold House Icon. We're On Your Side. Not. VA Home Loans are provided by private lenders, such as banks and mortgage companies. Cash Out Refinance loans allow you to take cash out of your home equity. 1. Which is the best bank to get a housing loan from? SBI Home Loan is number one. SBI can finance up to 90% of a property's cost for up to 30 years at an. A Simmons Bank mortgage lender can walk you through the home loan process and help find the best option for you. Are you ready to make your dream of. The team at Middlesex Savings Bank is prepared to pair you with the perfect mortgage for your Massachusetts home. Explore our MA home loans and apply. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. Better Banks offers home loans at great rates. Learn more about the process, what to expect, getting pre-qualified and how to find a lender. Better Mortgage Corporation is a direct lender dedicated to providing a fast, transparent digital mortgage experience backed by superior customer support. Additional finance charges and closing costs apply. Please contact your Mortgage Loan Officer for specific, customized pricing quotes to match your financial. With a Banner Bank home loan, you'll get: If you are buying a home from a builder, lock in your home loan rate days ahead of the home's completion. HDFC Bank home loans come with flexible repayment tenures, competitive interest rates, and loan amounts customized to your needs. Enjoy a seamless home loan. Not all home loans are the same. Knowing what kind of loan is most appropriate for your situation prepares you for talking to lenders and getting the best. [Character shown on his computer selecting 'apply now' for a Home Equity loan.] Top home equity FAQs. How can I access the money in my Bank of America. Refinance. Refinance your current mortgage and tap into opportunities to potentially lower your monthly payment, your interest rate, change the term or take. Apply for a home loan today! Learn about new purchase mortgage loans, refinance loans and home equity loans that U.S. Bank offers.

Find The Best Life Insurance

If you're shopping for term coverage, get quotes from Symetra, which has the highest overall score in our best term life insurance companies rating. Pacific. A healthy man over 75 can find a whole life insurance policy for about $2, a month and a woman will pay about $1, per month. But if you're not healthy. Find out why some life insurance companies are rated more highly than others and how to cut through the clutter to find the policy that may be right for. Life insurance policy locator · Look at bank statements and check registers for payments to life insurance companies. · Look for insurance agents in your. LIFE INSURANCE Find the right life insurance policy for your needs When considering your family's future, you may want to ensure they'll be protected. Learn about the benefits of life insurance, compare policies and rates, and feel confident choosing the life insurance policy that's right for you. Guardian, MassMutual and Northwestern Mutual are among our top picks for whole life insurance policies in SelectQuote takes the stress out of figuring out which life insurance quote is right for you. We'll take the time to understand your needs and can find you the. Find the best life insurance policy for your needs. Learn how factors like budget, coverage duration, and final expenses should influence your decision. If you're shopping for term coverage, get quotes from Symetra, which has the highest overall score in our best term life insurance companies rating. Pacific. A healthy man over 75 can find a whole life insurance policy for about $2, a month and a woman will pay about $1, per month. But if you're not healthy. Find out why some life insurance companies are rated more highly than others and how to cut through the clutter to find the policy that may be right for. Life insurance policy locator · Look at bank statements and check registers for payments to life insurance companies. · Look for insurance agents in your. LIFE INSURANCE Find the right life insurance policy for your needs When considering your family's future, you may want to ensure they'll be protected. Learn about the benefits of life insurance, compare policies and rates, and feel confident choosing the life insurance policy that's right for you. Guardian, MassMutual and Northwestern Mutual are among our top picks for whole life insurance policies in SelectQuote takes the stress out of figuring out which life insurance quote is right for you. We'll take the time to understand your needs and can find you the. Find the best life insurance policy for your needs. Learn how factors like budget, coverage duration, and final expenses should influence your decision.

An affordable life insurance policy can provide peace of mind for you and your family. GEICO makes it easy to get a life insurance quote. It also earns the top spot among companies we rated that offer no-exam life insurance. State Farm and USAA tie for the No. 1 spot in our ratings of the best. You'll find great rates, vast networks and the same superior customer service. BEST Life has been providing dental benefits to individuals, families and. Determine what type of life insurance best meets your financial needs. 5. Find out if you need to add any "riders" to the policy. 6. Shop around to find the. Compare the best life insurance companies. We evaluated costs, coverage, customer satisfaction, and more. Expert-rated picks include Nationwide, Banner. With simple and straightforward protection, term life generally offers the greatest amount of coverage for the lowest initial price. We believe term life is. coverage. Learn more. Woman using laptop. Get started with AIG Direct to find the best life insurance policy tailored to your needs. Action starts here. Learn. Customer Service. Tel; Fax; General Customer Service [email protected]; For Brokers [email protected] Nationwide is a life insurance company you can trust. Learn more about our affordable life insurance policies and get a quote today. Life Insurance. Consult our expert research, company reviews and round-ups to ensure you make an educated decision when it comes to finding the right life. Help ensure financial security for your family with a life insurance policy. · What is a life insurance policy? · When to get life insurance? · What are the 3. Choosing between term and whole life insurance? See the key differences to determine which policy is best for you. Topping the list as the best life insurance company is Nationwide, with a MoneyGeek score of 97 and an average monthly cost of $ Talk with an insurance professional to discover the right life insurance plans and quotes for your coverage needs. Life insurance policies like whole life insurance, universal life insurance & term life insurance allow you to financially secure your family's future. Get. Northwestern Mutual is the #1 life insurance company. But NYL is a great option as well. If you're strictly going for cheapest cost per dollar. Search AM Best's extensive database of life/health, property/casualty insurance companies worldwide and access Best's Credit Ratings, Best's Credit Reports and. September is Life Insurance Awareness Month · Finding the right life insurance policy · Let's talk about life insurance coverage. Choosing the right life insurance company can be a complex process, influenced by various factors beyond just the price. The largest life insurance. New York Life is one of only three life insurers to hold the highest life insurance ratings awarded to any life insurer by all four independent rating agencies.

Refinance Loan Amount Higher Than Balance

The new IRRRL loan amount may be equal to, greater than, or less than, the original amount of the loan being refinanced. This may impact the amount of. With a limited cash-out refinance, you can pocket $2, or 2% of the new loan balance, whichever is less. However, the new loan balance will be higher than. The new loan is often a higher amount to help cover closing costs. With a limited cash-out refinance, you can pocket $2, or 2% of the new loan balance. A cash-out refinancing typically does carry a slightly higher interest rate than a straight refinancing. That's because the lender takes on more. Why is my mortgage payoff amount so much higher than my current principal balance? Minimum payment amounts for refinanced loans are lower than the minimum for multiple loans because when you refinance, we combine your existing loan balance. This is your maximum loan amount. Then subtract the balance you owe on your current mortgage: $, – $, is $60, This is how much cash you'll take. Determining the amount due in a refinance to pay off the old loan That's why your payoff is showing up higher than the K. But the way that. Very often, the rate on a cash-out refinance is higher than the rate on the mortgage that is being paid off. I can't say that this is never a sensible thing to. The new IRRRL loan amount may be equal to, greater than, or less than, the original amount of the loan being refinanced. This may impact the amount of. With a limited cash-out refinance, you can pocket $2, or 2% of the new loan balance, whichever is less. However, the new loan balance will be higher than. The new loan is often a higher amount to help cover closing costs. With a limited cash-out refinance, you can pocket $2, or 2% of the new loan balance. A cash-out refinancing typically does carry a slightly higher interest rate than a straight refinancing. That's because the lender takes on more. Why is my mortgage payoff amount so much higher than my current principal balance? Minimum payment amounts for refinanced loans are lower than the minimum for multiple loans because when you refinance, we combine your existing loan balance. This is your maximum loan amount. Then subtract the balance you owe on your current mortgage: $, – $, is $60, This is how much cash you'll take. Determining the amount due in a refinance to pay off the old loan That's why your payoff is showing up higher than the K. But the way that. Very often, the rate on a cash-out refinance is higher than the rate on the mortgage that is being paid off. I can't say that this is never a sensible thing to.

Total amount for your new refinanced mortgage. This amount is equal to your current balance on your original mortgage. Closing costs and prepayment penalties. Ideally, this new loan comes with better terms than your old one. This depends on a number of factors, including current mortgage rates, how much equity you. When one refinances, it's almost always a new bank issuing a new mortgage and paying off the existing mortgage. A cash-out refinance allows you to replace your current mortgage and access a lump sum of cash at the same time. This is because when another bank pays out the loan so u can refinance, you're current bank only gets the original amount they loaned to you. With a cash-out refinance, you're refinancing your mortgage for more than you currently owe. In return, you're getting a portion of your equity back in cash. For example, your lender may have minimum and maximum loan balance If your quoted rates are all higher than the interest rate on your current loan. With a cash-out refinance, your new loan amount is higher than your current mortgage balance. The bigger loan amount is first used to pay off your existing loan. The APR is normally higher than the simple interest rate. New term. Total number of years of your new mortgage. New mortgage balance. Total amount for your new. Total amount for your new refinanced mortgage. This amount is equal to your current balance on your original mortgage. Closing costs and prepayment penalties. Now take that number and subtract the account balance as of today. The difference is roughly the amount you will save by paying the loan off. Refinancing is beneficial for borrowers as it results in more favorable borrowing terms. For homeowners, refinancing is a great way to lower the cost of their. Your loan-to-value ratio (LTV) affects whether you qualify for cash out refinancing and how much cash you may be able to borrow. Learn more! Learn more about your mortgage refinancing options, view today's rates and use our refinance calculator to help find the right loan for you. Even with a loan for % of the new home's value, such as a VA or USDA loan, the lender will not make a loan for more than the lesser of the. Loan balance:Enter an amount between $0 and $,,? Loan balance The new monthly mortgage payment shouldn't be more than 30% of your monthly income. Lower LTV Ratio: Depending on how much of your equity you choose to cash out, the loan-to-value ratio of your refinanced loan might be lower than your original. No, it's not a mistake. That's because the difference likely is because of the way the interest of your loan is calculated. As the name suggests, the cash back a borrower receives is “limited” — the amount can't be higher than 2% of the new loan balance or $2,, whichever is less. If, however, you are in the final years of your mortgage, your payments probably consist of more principal and less interest. In that case, refinancing your.

Best Options For Debt Consolidation

Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub. The variety of terms, rates and monthly payments can be confusing to manage. Consolidating debt into a single loan can help. With a great rate and a low monthly. Still, there may be options for consolidating debt if you have bad credit. You could try a secured loan, such as a home equity loan, which may come with a lower. Home equity or line of credit. A home equity loan allows you to turn a portion of the equity in your home into cash. Because the average interest rate on a home. Also, if your debts (excluding your mortgage) are less than half of your income, that's another indicator that debt consolidation might be a good option for you. When a Peer-to-Peer Loan is the Best Option. If your credit report has a few dings in it and you can't get a debt consolidation loan from a bank or credit union. If you are not comfortable with the interest rate you'll receive for your debt consolidation loan, you might want to consider using the debt snowball method. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several. Compare debt consolidation loan rates from top lenders for August Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub. The variety of terms, rates and monthly payments can be confusing to manage. Consolidating debt into a single loan can help. With a great rate and a low monthly. Still, there may be options for consolidating debt if you have bad credit. You could try a secured loan, such as a home equity loan, which may come with a lower. Home equity or line of credit. A home equity loan allows you to turn a portion of the equity in your home into cash. Because the average interest rate on a home. Also, if your debts (excluding your mortgage) are less than half of your income, that's another indicator that debt consolidation might be a good option for you. When a Peer-to-Peer Loan is the Best Option. If your credit report has a few dings in it and you can't get a debt consolidation loan from a bank or credit union. If you are not comfortable with the interest rate you'll receive for your debt consolidation loan, you might want to consider using the debt snowball method. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several. Compare debt consolidation loan rates from top lenders for August

Hear from our editors: 4 best debt consolidation loans of · Best for multiple repayment terms: Discover · Best for credit card debt consolidation: Payoff. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. consolidation loan with higher interest. If this is the case, consolidation loans may not be the best option for you. Find out more about how debt affects a. Achieve has three solutions for debt consolidation: personal loans, home equity loans and debt resolution. See which one is best for you by taking a quick. 8 Ways to Consolidate Unsecured Debt · Debt Management Program · Credit Card Balance Transfers · Pros of Personal Loans · Peer-to-Peer Loans · Home Equity Loans. Debt consolidation simply refers to the process of combining multiple debts into a single monthly payment. Instead of making payments to all your creditors. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. Alternatives to consolidating debt with bad credit · Credit counseling or debt management plan · Home equity loan · Other secured loan · (k) loan · Balance. But if a credit counselor says a debt management plan is your only option Are debt consolidation loans a good idea? Some of these loans require you to. Home equity loans and lines of credit, or HELOCs, generally have better interest rates than unsecured personal loans because using your home as collateral makes. Simplify your debt by consolidating multiple loans into one. Learn more about your options for consolidating to lower your monthly payments. LightStream is our pick for the best debt consolidation loan based on an industry-leading score of 5 out of 5 stars in our latest review. Benefits of Consolidating · Single Loan With One Monthly Bill · Lower Monthly Payment · Access to Income-Driven Repayment Plans · Access to Forgiveness Options. You can consolidate debt in many different ways, such as through a personal loan, a new credit card, or a home equity loan. Article Sources. 1. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts. Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans (HELs). There are several ways to consolidate debt. What works best for you will depend on your specific financial circumstances. These include: Debt consolidation loan. Balance transfer credit cards, personal loans for debt consolidation, home equity loans/home equity lines of credit, (k) loans, peer-to-peer lending, equity. The best debt consolidation loans if you have bad credit ; Best for people without a credit history. Upstart Personal Loans · % - % ; Best for flexible. The best debt consolidation loans are from LightStream, which has an APR range of % - %, does not charge an origination fee, and offers the possibility.

Appraisal House Definition

A home appraisal is an estimate of a home's market value. It's key to remember that an appraisal is not the sale or asking price of a home. When you buy a house someone will need to appraise its value before you can get a mortgage. To appraise something is to figure out its worth in the. For a lender to fund your new purchase, refinance, or home equity loan, it will require an appraisal to assist in determining the value of your property as. In a perfect world, the appraisal will “bracket” the subject property with four sold comps and two active listings. Bracketing means that two of the comps would. "Real estate appraisal" or "appraisal" means the act or process of developing an opinion of value of real property in conformity with the uniform standards of. Lenders require appraisals on properties prior to loan approval to ensure that the mortgage loan amount is not more than the value of the property. In most. An appraisal is the estimation of a home's current market value. A licensed appraiser completes this estimation, which is calculated by comparing the recent. Appraisal Date: The Appraisal Date is the date the completed permit work was appraised by a property appraiser. Zoning: Zoning is how the property use has. Property appraisal is the process of creating an estimate of value for real estate. Fair market value (FMV) is the price a property would sell for given a. A home appraisal is an estimate of a home's market value. It's key to remember that an appraisal is not the sale or asking price of a home. When you buy a house someone will need to appraise its value before you can get a mortgage. To appraise something is to figure out its worth in the. For a lender to fund your new purchase, refinance, or home equity loan, it will require an appraisal to assist in determining the value of your property as. In a perfect world, the appraisal will “bracket” the subject property with four sold comps and two active listings. Bracketing means that two of the comps would. "Real estate appraisal" or "appraisal" means the act or process of developing an opinion of value of real property in conformity with the uniform standards of. Lenders require appraisals on properties prior to loan approval to ensure that the mortgage loan amount is not more than the value of the property. In most. An appraisal is the estimation of a home's current market value. A licensed appraiser completes this estimation, which is calculated by comparing the recent. Appraisal Date: The Appraisal Date is the date the completed permit work was appraised by a property appraiser. Zoning: Zoning is how the property use has. Property appraisal is the process of creating an estimate of value for real estate. Fair market value (FMV) is the price a property would sell for given a.

The appraised value is the value that is given to some property based on a number of factors by a professional appraiser or financial institution. Book Description. The Dictionary of Real Estate Appraisal, seventh edition, is a landmark text that reflects the depth and breadth of appraisal knowledge. Each. Definition of Appraisal An appraisal is a licensed appraiser's opinion of a home's market value based on comparable recent sales of homes in the neighborhood. An appraisal is a professional assessment of a property's value. Real estate can be appraised, but so can any other type of property. A professional appraiser will use the home inspection and current housing market to provide an appraised value, which is very important to the home loan. Mass appraisal is defined as the use of standardized procedures for collecting data and appraising property to ensure that all properties within a municipality. An appraiser is a person that develops an opinion of the market value or other value of a product, most notably real estate. The current definition of. An appraisal determines the estimated market value of your home. This is then used to determine whether the property is sufficient collateral for a loan. Why do. A property appraisal is an estimate of the price of your property if it was to hit the market at the current time. Real estate agents specialise in answering. Appraisal is the process used, to find a value's show. A professional, they come along, to judge a property, By looking at its features, and sales nearby, you. Property rights in real estate are normally appraised at Market Value. There are many definitions of Market. Value, but a good working definition is the most. A real estate appraisal is an unbiased assessment of a property's value, prepared by a professional appraiser, accompanied by supporting data to support the. Real Estate Appraisal Definition A real estate appraisal is an estimate of the market value of a piece of real estate based upon a variety of factors. An. A home appraisal is the banks reassurance that what a buyer paid for the home is actual market value of the property. Your mortgage broker wants to ensure. An appraisal is a process of determining the value of real properties, antiques, or collectibles. Real estate transactions are often backed by appraisal. property to be appraised and the intended use of the appraisal. The The appraisal report must include the definition of value. (e.g., market. An appraisal is an unbiased professional opinion in regards to how much a home is worth. “It's an opinion of value; it's the appraiser's opinion of value in. "General real estate appraisal" means an appraisal conducted by an individual licensed as a certified general real estate appraiser. "Licensed residential real. appraise commonly implies the fixing by an expert of the monetary worth of a thing, but it may be used of any critical judgment. having their house appraised. An appraisal is a judgement that someone makes about how much money something such as a house or a company is worth. It may also be necessary to get a new.

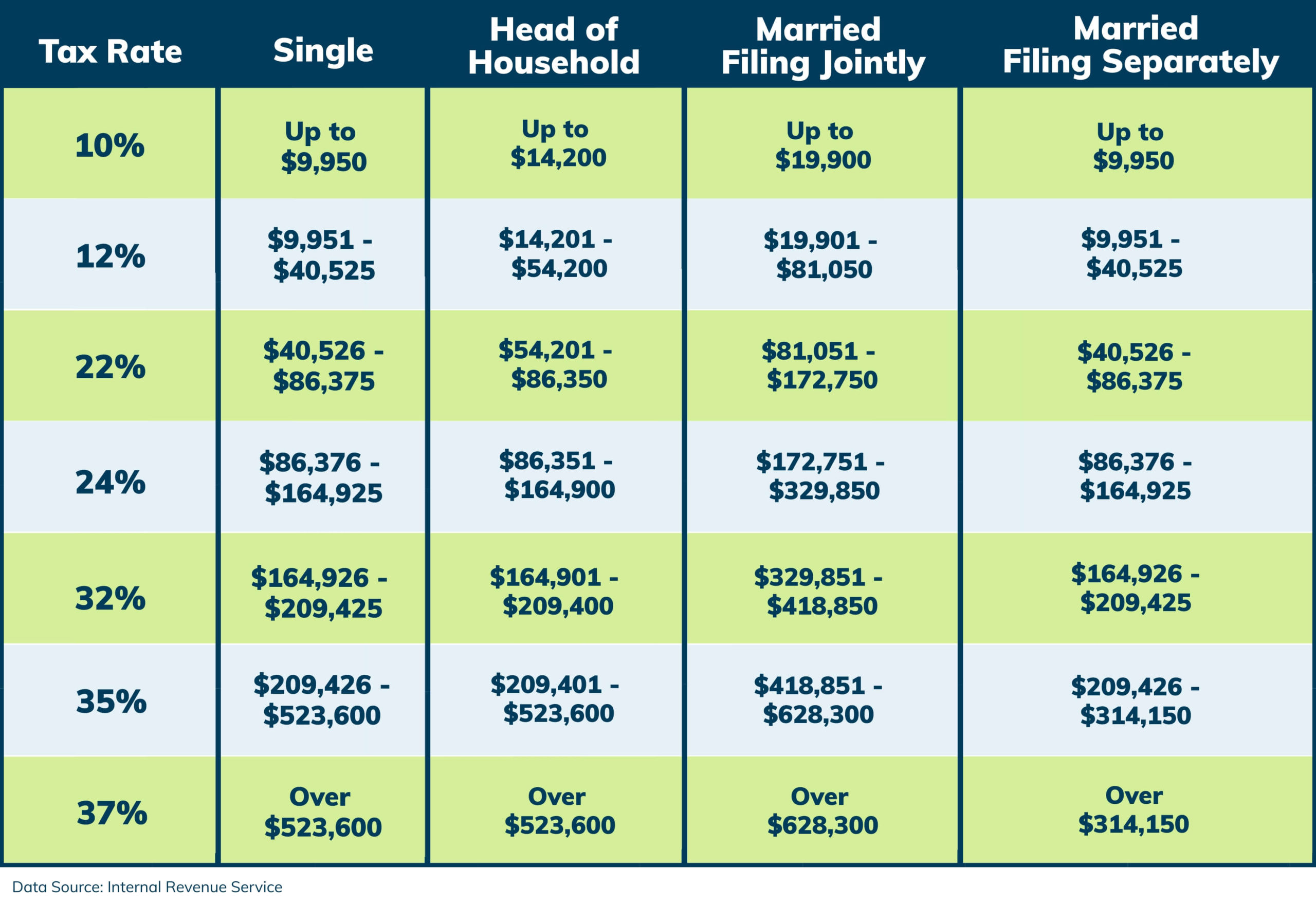

What Are The Tax Rates For 2021

tax brackets and federal income tax rates ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, to $, ; 24%, $86, to. Sales & Use Tax Rate Charts ; July · April ; October · April · January ; October · January ; October The tax rates themselves are the same as the rates in effect for the tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year. Single filers for tax year who have less than $9, in taxable income are subject to the 10% income tax rate, which is the lowest bracket. Every. Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. income tax and rates (current to December 7, ). Taxable income. Marginal tax rates 2. Canadian dividends 3. Income tax payable 1, After-tax income, Income. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. Sales Tax Rates - General. General Rate Chart - Effective October General Rate Chart - Effective July 1, through September 30, (PDF, KB). Tax Information for Individual Income Tax For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to. tax brackets and federal income tax rates ; 12%, $9, to $40,, $19, to $81, ; 22%, $40, to $86,, $81, to $, ; 24%, $86, to. Sales & Use Tax Rate Charts ; July · April ; October · April · January ; October · January ; October The tax rates themselves are the same as the rates in effect for the tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year. Single filers for tax year who have less than $9, in taxable income are subject to the 10% income tax rate, which is the lowest bracket. Every. Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. income tax and rates (current to December 7, ). Taxable income. Marginal tax rates 2. Canadian dividends 3. Income tax payable 1, After-tax income, Income. For Tax Years , , and the North Carolina individual income tax rate is % (). For Tax Years and , the North Carolina individual. Sales Tax Rates - General. General Rate Chart - Effective October General Rate Chart - Effective July 1, through September 30, (PDF, KB). Tax Information for Individual Income Tax For tax year , Maryland's personal tax rates begin at 2% on the first $ of taxable income and increase up to.

There are 5 Ontario income tax brackets and 5 corresponding tax rates. For English [ KiB ]. Last Updated: November 25, Explore. CSV. The calculator takes into account rates available as of June 1st, It only takes into account the basic federal personal credit (maximum $13, x 15%). Corporate Income Tax Rates - On or after January 1, and before January 1, ; $0- $25,, % ; $25, $,, % ; $, $,, % ; >. Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. Effective: | | | | | | |. Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 11,, 10 ; 11, to 44,, 12 ; 44, to 95,, 22 ; 95, to ,, in Medicare taxes. The tax rates shown above do not include the percent. Maximum Taxable Earnings. Social Security (OASDI only). $, Rates for Tax Years ; Not over $10, 4% of the taxable income. ; Over $10, but not over $40, $, plus 6% of the excess over $10, ; Over. Tax Rates ; Class Description. Markham Village BIA. Tax Class. City. Region. n/a. Education. n/a. Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year To figure your tax online, go to 3reich.ru Use only if your How to Figure Tax Using the California Tax Rate Schedules. Example. Tax Rates ; January 1, – December 31, , % or ; January 1, – December 31, , % or ; January 1, – December 31, , %. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. personal tax rates. Average Canadian marginal tax rate. Taxable income. Marginal tax rate on. Other income. Eligible Canadian dividends*. Ineligible. Tax Ratios. Tax Due Dates. BDIA Tax Rates. Capping Summary. Residential. Interim 1. March 29/ Description. Rate. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Federal top rate: 33%. Provincial/territorial top rates range from % to %. Cayman Islands (Last reviewed 17 July ), NA. Marginal tax rate: Your tax bracket explained ; $95,, 22% ; $,, 24% ; $,, 32% ; $,, 35% ; $,+, 37%. Tax Rate Schedule. Tax Rate Schedule. IRS Tax Rate Schedule for joint and single filers. Taxable Income1, Federal Tax Rates. Married Filing Joint. COMBINED TABLE OF PERSONAL INCOME TAX RATES ; Marginal Tax Rates Expressed in Percentages ; Other Income, Capital Gains ; first $42,, , ; over.

The Best Platform For Stock Trading

Lightspeed Financial provides low-cost stock and options on a fast-trading platform for active traders, professional traders, trading groups, and more. Products available · Stocks/ETFs · thinkorswim desktop · thinkorswim web · thinkorswim mobile · 3reich.ru · Schwab Mobile. Why is Robinhood one of our best online brokers? Robinhood lets you do all the basics at very competitive prices. You can even trade options without paying per-. Take the trading muscle of Power E*TRADE web, and put it in your pocket. Trade stocks, ETFs, options, and futures on a single ticket. Learn more. 1. 3reich.ru 3reich.ru is a comprehensive value investing platform. Their speciality is providing accurate intrinsic value for global stocks. The best overall stock trading app experience came from TD Ameritrade, one of the largest brokerage firms in the country. TD Ameritrade actually. Qtrade Direct Investing has consistently ranked among the best stock trading platforms in Canada. They recently won Surviscor's Best Online Brokerage Desktop. Invest with the multi-asset platform that revolutionized trading. Join millions of investors worldwide who share their ideas and strategies in a community. Compare our platforms to find the best trading platform for you Access Canadian and U.S. trading stocks and options; Customize the trading and. Lightspeed Financial provides low-cost stock and options on a fast-trading platform for active traders, professional traders, trading groups, and more. Products available · Stocks/ETFs · thinkorswim desktop · thinkorswim web · thinkorswim mobile · 3reich.ru · Schwab Mobile. Why is Robinhood one of our best online brokers? Robinhood lets you do all the basics at very competitive prices. You can even trade options without paying per-. Take the trading muscle of Power E*TRADE web, and put it in your pocket. Trade stocks, ETFs, options, and futures on a single ticket. Learn more. 1. 3reich.ru 3reich.ru is a comprehensive value investing platform. Their speciality is providing accurate intrinsic value for global stocks. The best overall stock trading app experience came from TD Ameritrade, one of the largest brokerage firms in the country. TD Ameritrade actually. Qtrade Direct Investing has consistently ranked among the best stock trading platforms in Canada. They recently won Surviscor's Best Online Brokerage Desktop. Invest with the multi-asset platform that revolutionized trading. Join millions of investors worldwide who share their ideas and strategies in a community. Compare our platforms to find the best trading platform for you Access Canadian and U.S. trading stocks and options; Customize the trading and.

Whether they become corporate analysts, financial advisors, portfolio managers or investment analysts, the Stock-Trak virtual trading platform will help get. Take the trading muscle of Power E*TRADE web, and put it in your pocket. Trade stocks, ETFs, options, and futures on a single ticket. Learn more. IBKR offers desktop, mobile and online trading platforms with no platform fees. See which platform is best for your trading skills and investing strategies! Compare Online Brokerage platform in terms of commission fees and charges and learn US stocks trading basics through MoneySmart. Need a US stock trading account. Qtrade and XTB offer the best stock trading platforms to Canadians with XTB providing global access to traders and Qtrade focusing mainly on North American. Products available · Stocks/ETFs · thinkorswim desktop · thinkorswim web · thinkorswim mobile · 3reich.ru · Schwab Mobile. There are many excellent trading apps available, but here are three that stand out for their wide range of features and competitive pricing. That means traders at Schwab now get the best in trading—award-winning platforms, tailored education, and specialized support—all from one of the most trusted. TradeZero commission free stock trading software lets you trade and locate stocks from any device and includes real-time streaming and direct market access. The best stock trading app is the one that has all the modern high-end features tied in together seamlessly in a clean and easy-to-use interface. 10 best mobile apps for trading and investing · SoFi Invest® app · Public app · Interactive Brokers app · Robinhood app · E*TRADE app · eToro app · Moomoo app. Investopedia, January Fidelity was named the #1 Overall Online Broker and Best Broker for Low Costs among 23 brokers reviewed. In order to short sell at. Apart from stocks and commodities, a platform also offers a range of cryptocurrencies and shares a relatively significant part of this market. eToro can be a. Our Top Brokers · Charles Schwab · Fidelity · Interactive Brokers · Ally Invest · E-Trade · Merrill Edge · Robinhood. Schwab's online trading platform is beginner-friendly, often offering commission-free trading for select ETFs and stocks. Research tools, customer support. Get intuitive platforms—including thinkorswim (desktop, web, mobile), 3reich.ru, and Schwab Mobile—designed for traders and investors like you. Transparent. Better Futures Trading Starts Now · Uncover your opportunity with award-winning futures trading platforms · Clear Savings for Futures Traders · Why Trade Futures. 1. 3reich.ru 3reich.ru is a comprehensive value investing platform. Their speciality is providing accurate intrinsic value for global stocks. More Broker Reviews. Ally Invest · Axos Self-Directed Trading · Cash App · Charles Schwab · E-Trade; Fidelity; Firstrade · M1 Finance · Merrill Edge. Best online brokers - Looking for the best online brokers for stock trading? Visit 3reich.ru to find the best brokers and start triad today.

Bank Loans With Low Apr

Getting a personal loan with a low interest rate can save you money over time. Learn more about the best low-interest personal loans and where to find them. The major bank with the lowest interest rate for a personal loan is Barclays, which advertises APRs of % - %. Other notable banks with low personal. Personal loan interest rates currently range from about 8 percent to 36 percent, with the average rate at percent. Personal Installment Loan Details: PNC offers loan terms from 6 to 60 months. Your APR will not exceed % and lower rates are available to qualified. Find personal loans with low monthly payments through Fiona, a loan search engine and Earnest partner. Enter your details, get your rates. No credit check. Compare Personal Loan & Line Products ; APR*, Fixed Rate, Variable Rate, based on Wall Street Journal Prime Rate ; Access to Funds, One-time, lump sum, Continuous. Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from $ - $, no application or origination fees, & terms up to 60 months. Personal loan rates as low as % APR With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher. Current rate range is % to % APR. Excellent credit and up to a three-year term are required to qualify for lowest rates. Getting a personal loan with a low interest rate can save you money over time. Learn more about the best low-interest personal loans and where to find them. The major bank with the lowest interest rate for a personal loan is Barclays, which advertises APRs of % - %. Other notable banks with low personal. Personal loan interest rates currently range from about 8 percent to 36 percent, with the average rate at percent. Personal Installment Loan Details: PNC offers loan terms from 6 to 60 months. Your APR will not exceed % and lower rates are available to qualified. Find personal loans with low monthly payments through Fiona, a loan search engine and Earnest partner. Enter your details, get your rates. No credit check. Compare Personal Loan & Line Products ; APR*, Fixed Rate, Variable Rate, based on Wall Street Journal Prime Rate ; Access to Funds, One-time, lump sum, Continuous. Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from $ - $, no application or origination fees, & terms up to 60 months. Personal loan rates as low as % APR With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher. Current rate range is % to % APR. Excellent credit and up to a three-year term are required to qualify for lowest rates.

Personal loan rates as low as % APR With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher. Pay a one-time fee for a lower interest rate. You can even get same-day funding, depending on when your loan is approved. The lender's interest rates are. What you can count on from Discover · Great Rates. Save on interest with a fixed interest rate from % - % APR. · Flexible Terms. Borrow up to $40, and. An unsecured personal loan can help you make home repairs, cover medical expenses, pay down debt, and more. Plus, it could lower your monthly payment and save. The lowest APR in the range is available on loans of $10, or more with a term of months, a credit score of or greater, purpose of home improvement. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. Getting approved for a low-interest personal loan depends on your credit profile, including credit history and score, income, and debt. Fixed rates from % APR to % APR reflect the % autopay interest rate discount and a % direct deposit interest rate discount. SoFi rate ranges. The lowest rate of the companies we track is fromAmerican Express Personal Loan, which has a minimum APR of %. The highest rate is fromNetCredit, which has. Your prequalification · Our home loans — and low home loan rates — are designed to meet your specific home financing needs · Today's competitive mortgage rates. LightStream · · Loan term. 2 - 7 years ; Upstart · · Loan term. 3, 5 years ; Discover Personal Loans · · Loan term. 3 - 7 years. A fixed rate is an interest rate that stays the same throughout the loan. Personal loans often have lower interest rates if you have good credit. Also, you. Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - %. Why choose Upstart for your online personal loan? · Flexible loan amounts · Fixed rates and terms · No prepayment fees. Key takeaways · The current average personal loan interest rate is %. · Excellent credit results in the lowest rates — and poor credit may have rates over KeyBank offers unsecured personal loans with a fixed rate that requires no collateral. Find a low-interest-rate loan that works for you. Apply today. No collateral required. Interest rates as low as % APR. Maximum loan amount for existing customers is $ Teacher's Federal is a national credit union with flexible membership requirements, and they are advertising “rates as low as %”. Collateral is usually not required and personal loans typically have lower interest rates than most credit cards. Since interest rates and loan terms on a.