3reich.ru

Overview

Svm Stock Forecast

SVM | Complete Silvercorp Metals Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Is Silvercorp Metals Inc stock a good buy? Based on ratings from 5 analysts Silvercorp Metals Inc's stock is Strong Buy. Stock Target Advisor's fundamental. Find the latest Silvercorp Metals Inc. (SVM) stock quote, history, news and other vital information to help you with your stock trading and investing. Sovereign Metals Stock Forecast, SVM stock price prediction. Price target in 14 days: AUD. The best long-term & short-term Sovereign Metals share. Stock analysis for Silvercorp Metals Inc (SVM:Toronto) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Silvercorp Metals Stock Forecast, SVM stock price prediction. Price target in 14 days: USD. The best long-term & short-term Silvercorp Metals share. The forecasts for Silvercorp Metals Inc. (SVM) range from a low of $ to a high of $ The average price target represents a increase of $ from the. Analyst Future Growth Forecasts Earnings vs Savings Rate: SVM's forecast earnings growth (% per year) is above the savings rate (%). Earnings vs Market. SILVERCORP REPORTS ADJUSTED NET INCOME OF $ MILLION, $ PER SHARE,AND CASH FLOW FROM OPERATIONS OF $ MILLION FOR Q1 FISCAL Silvercorp Metals. SVM | Complete Silvercorp Metals Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Is Silvercorp Metals Inc stock a good buy? Based on ratings from 5 analysts Silvercorp Metals Inc's stock is Strong Buy. Stock Target Advisor's fundamental. Find the latest Silvercorp Metals Inc. (SVM) stock quote, history, news and other vital information to help you with your stock trading and investing. Sovereign Metals Stock Forecast, SVM stock price prediction. Price target in 14 days: AUD. The best long-term & short-term Sovereign Metals share. Stock analysis for Silvercorp Metals Inc (SVM:Toronto) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Silvercorp Metals Stock Forecast, SVM stock price prediction. Price target in 14 days: USD. The best long-term & short-term Silvercorp Metals share. The forecasts for Silvercorp Metals Inc. (SVM) range from a low of $ to a high of $ The average price target represents a increase of $ from the. Analyst Future Growth Forecasts Earnings vs Savings Rate: SVM's forecast earnings growth (% per year) is above the savings rate (%). Earnings vs Market. SILVERCORP REPORTS ADJUSTED NET INCOME OF $ MILLION, $ PER SHARE,AND CASH FLOW FROM OPERATIONS OF $ MILLION FOR Q1 FISCAL Silvercorp Metals.

SVM's current price target is C$ Learn why top analysts are making this stock forecast for Silvercorp Metals at MarketBeat. Based on analysts offering 12 month price targets for SVM in the last 3 months. The average price target is $ with a high estimate of $ and a. Find the latest Silvercorp Metals Inc (SVM) stock forecast, month price target, predictions and analyst recommendations. The 1 analyst with a month price forecast for Silvercorp Metals stock has a target of , which predicts an increase of % from the current stock price. View Silvercorp Metals Inc. SVM stock quote prices, financial information, real-time forecasts, and company news from CNN. Silvercorp Metals Inc Stock (SVM) is expected to reach an average price of $ in , with a high prediction of $ and a low estimate of $ This. Wall Street analysts forecast SVM stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for SVM is. According to analysts, SVM price target is CAD with a max estimate of CAD and a min estimate of CAD. Check if this forecast comes true in a year. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. VANCOUVER, British Columbia (AP) — Silvercorp Metals Inc. SVM) on Tuesday reported net income of $ million in its fiscal first quarter. The Vancouver. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. SVM Stock Overview · Price-To-Earnings ratio (x) is below the Metals and Mining industry average (x) · Earnings are forecast to grow % per year. Silvercorp Metals (SVM) stock price prediction is USD. The Silvercorp Metals stock forecast is USD for September The Wall Street analyst predicted that Silvercorp Metals's share price could reach $ by Aug 21, The average Silvercorp Metals stock price prediction. Based on the share price being below its 5, 20 & 50 day exponential moving averages, the current trend is considered strongly bearish and 3reich.ru is experiencing. The current price of SVM is CAD — it has decreased by −% in the past 24 hours. Watch SILVERCORP METALS INC stock price performance more closely on the. Over the last 12 months, its price rose by percent. Looking ahead, we forecast Silvercorp Metals Inc to be priced at by the end of this quarter and. Silvercorp Metals Inc.'s stock symbol is SVM and currently trades under NYSE. It's current price per share is approximately $ View Silvercorp Metals Inc SVM investment & stock information. Get the latest Silvercorp Metals Inc SVM detailed stock quotes, stock data, Real-Time ECN. Get Silvercorp Metals Inc (SVM:NYSE American) real-time stock quotes, news, price and financial information from CNBC.

The Northland Group

NOTICE: The Northland Group is once again meeting in-person daily at the SAF facility. We are following City Guidelines for safety. Northland Group is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor and are. Since Northland Group has been a leading provider of recovery solutions for the financial services industry. From first party to late stage recovery. The Northland Group, Kerikeri, New Zealand. 74 likes. A Big Little Construction Company. Northland Group, Minneapolis, MN. 21 likes · 63 were here. Collection Agency. NORTHLAND GROUP, Seattle, WA , Mon - am - pm, Tue - am - pm, Wed - am - pm, Thu - am - pm, Fri - am - Northland Group Inc is a third-party debt collection agency. It is based out of Edina, Minnesota, and has been operating since Focusing on mainly credit. Northland Group is a debt collection agency located in Minneapolis, Minnesota. Phone, address and details about the agency. Northland Group is a debt collection agency that specializes in purchasing and collecting overdue accounts. If you're seeing them on your credit report you. NOTICE: The Northland Group is once again meeting in-person daily at the SAF facility. We are following City Guidelines for safety. Northland Group is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor and are. Since Northland Group has been a leading provider of recovery solutions for the financial services industry. From first party to late stage recovery. The Northland Group, Kerikeri, New Zealand. 74 likes. A Big Little Construction Company. Northland Group, Minneapolis, MN. 21 likes · 63 were here. Collection Agency. NORTHLAND GROUP, Seattle, WA , Mon - am - pm, Tue - am - pm, Wed - am - pm, Thu - am - pm, Fri - am - Northland Group Inc is a third-party debt collection agency. It is based out of Edina, Minnesota, and has been operating since Focusing on mainly credit. Northland Group is a debt collection agency located in Minneapolis, Minnesota. Phone, address and details about the agency. Northland Group is a debt collection agency that specializes in purchasing and collecting overdue accounts. If you're seeing them on your credit report you.

Based in Kerikeri, Northland, The Northland Group designs and constructs complete build solutions across all industries. Talk to us today. If you are receiving harassing calls by Northland Group - Call us today for Free legal help! It all began with Northland Real Estate Group, who developed the vision for the site and partnered with The Good Man Group to bring this project to fruition. Northland Group Incorporated | 11 followers on LinkedIn. Elevating Treasury Management Solutions | Northland is a consulting firm and solutions provider. Who is Northland Group? They are an Edina, Minnesota-based debt collection agency that collects various types of debt, including credit cards. They have clients. Since Northland Group has been a leading provider of recovery solutions for the financial services industry. From first party to late stage recovery. Northland Group Inc.. The Law Office of Simon Goldenberg, PLLC seeks debt solutions for clients looking to avoid bankruptcy. Contact our New York debt. Founded in by John Johnson, Northland Group provides business process outsourcing services focused on debt collection services for national credit grantors. NORTHLAND GROUP, Glenroy Rd, Ste , Minneapolis, MN , Mon - am - pm, Tue - am - pm, Wed - am - pm. Whether you have questions, inquires or partnership opportunities, our team is here to assist you. Explore how our diversified portfolio is driving the. Northland Group is a financial advisor in the Hermantown, MN area with Thrivent, a Fortune financial services organization with a + year history. Recommended Reviews - Northland Group · Map · Glenroy Rd. Ste Minneapolis, MN Directions · () Call Now · More Info. Hours. Northland is an industry-leading real estate private equity firm that relies on A group of professionals gathered in a conference room for a meeting. For general questions and information about our services, please contact Northland Group, RA. Visit our website today and learn more. Meet our team at Northland Group and start a conversation with one of our experiences staff members about how our solution can work for you. The SAF Clubhouse was built more than 50 years ago to provide a permanent home for AA in Austin. The Northland AA Group meets here seven days a week. If you. Facts about debt collector Northland Group, Inc., Complaints and Lawsuits. Northland Group is an Minnesota collection agency. Minnesota collection agencies can help businesses, medical practices and facilities that are creditors to. 3reich.ru, your premier online resource for Chippewa Falls homes for sale and Lake Wissota real estate. The Northland Group collaborates with three unique suppliers to provide a comprehensive design and budget for your project.

Self Employed Bookkeeping Software Free

FreshBooks accounting software for self-employed professionals lets you invoice, track expenses, log time and view insightful reports. It now costs $8 per month if you want the ability to scan and upload expense receipts, a feature many other small business accounting apps offer for free. Wave's accounting software is designed for self-employed people and freelancers like you, and can be easily customized for any size business. Zoho offers powerful drag-and-drop, customizable invoices alongside tools for calculating, creating and filing tax returns and reports. Zoho Books' day free. Xero is popular with freelancers and entrepreneurs of all stripes, from writers to graphic designers. If you're looking for the most basic self-employed. Keeping your finances organized is easier than ever with Found's integrated—and free—bookkeeping tools. Automatic expense tracking. Receipt capture. Here are the best free accounting software available: Wave. ZipBooks. Akaunting. SlickPie. GnuCash. CloudBooks. Zoho Invoice. NCH Express. Button-up your bookkeeping to make tax time suck less. Start for free, or learn about our Pro Plan features below. Email Address Password. Zoho Books offers free accounting software for small businesses with turnover below $50K. Try the best free online accounting software now! FreshBooks accounting software for self-employed professionals lets you invoice, track expenses, log time and view insightful reports. It now costs $8 per month if you want the ability to scan and upload expense receipts, a feature many other small business accounting apps offer for free. Wave's accounting software is designed for self-employed people and freelancers like you, and can be easily customized for any size business. Zoho offers powerful drag-and-drop, customizable invoices alongside tools for calculating, creating and filing tax returns and reports. Zoho Books' day free. Xero is popular with freelancers and entrepreneurs of all stripes, from writers to graphic designers. If you're looking for the most basic self-employed. Keeping your finances organized is easier than ever with Found's integrated—and free—bookkeeping tools. Automatic expense tracking. Receipt capture. Here are the best free accounting software available: Wave. ZipBooks. Akaunting. SlickPie. GnuCash. CloudBooks. Zoho Invoice. NCH Express. Button-up your bookkeeping to make tax time suck less. Start for free, or learn about our Pro Plan features below. Email Address Password. Zoho Books offers free accounting software for small businesses with turnover below $50K. Try the best free online accounting software now!

We figure that Crunch is unique within the UK accountancy software market. We built Crunch Free to self-employed help professionals grow their business. Digital record-keeping software that simplifies the finances of sole traders and self-employed professionals. Pick from our free plan or our more. Simply put, the one that you will actually use. If you're a small business owner or self employed freelancer, you need a powerful system that is dead simple to. With Coconut, you can get exceptionally organised, spend less energy on financial admin, and free up your time to do what you do best: running your business. Wave really is free bookkeeping software. This year, it introduced a paid plan at $16 per month that reduces the online payment fees, automates data entry, and. QuickBooks Self-Employed is the all in one finance app for self-employed workers, freelancers, sole-traders, contractors, and sole proprietors. Free, easy to use accounting software for the self-employed. Power through your invoicing, get paid faster, and keep track of every expense with Pandle. Best Accounting Software for Freelancers · Freshbooks · Collective · Moxie · Xero · Quickbooks · Bonsai · Zoho Books. Best free Accounting Software across 87 Accounting Software products. See reviews of QuickBooks Online, Sage Intacct, QuickBooks Desktop Pro and compare. Zoho Books makes accounting for the self-employed easy and painless with features like quotes, invoices, expense management, taxes, time tracking, and online. QuickBooks Solopreneur is custom-built for your business of one. Manage your finances like a pro with our low cost self-employed accounting software today. Looking for freelance accounting software? Use Bonsai's freelance accounting app to manage your freelance bookkeeping! You can try FreshBooks free for 30 days to see if it's the right choice for your freelance business. If you're weighing the decision between Freshbooks vs. Small Business Accounting 4+. Bookkeeping for Self Employed. Monelyze Inc. Free. In-App Purchases. Premium Service - Monthly $; Premium Service. Is saving money on software your top priority? Wave's completely free accounting software includes unlimited invoicing, expense tracking, and receipt scanning. Free and low-cost accounting and invoicing software · AccountEdge · Actif · Connected Core Accounting · Dynacom Accounting SMB Edition · FreshBooks · Gestion PME. Send invoices and manage finances easily with accounting software for freelancers, sole traders, sole-proprietors, and the self-employed. Answers to frequently asked questions when using electronic accounting software record files in Small Business/Self-employed examinations. FreshBooks supports self-employed professionals with tailored solutions to simplify their finances and streamline their business operations. Akaunting is a free, open-source, and online accounting software for small businesses and freelancers. Get Started. Akaunting Dashboard. Free Bookkeeping.

Using Bonds As Collateral For A Loan

Stocks and bonds: These financial assets can be used as collateral for a loan It is also important to note that using collateral to secure a. purchase mortgage loans using bond proceeds. Such mortgage loans generally In order to be considered eligible collateral, except for Housing Revenue Bonds. The federal government regulates the use of stocks and bonds as collateral for loans. There are limits on what securities can be used and how much can be. Using your securities to borrow money. You can use securities as collateral for a loan. Here's what you need to know. Fidelity Learn. Key takeaways. You can. You might use the funds to acquire additional artwork or to take advantage of another opportunity. Borrowing against a potentially appreciating asset (like a. A secured personal loan can be used for almost any purpose, like fixing a home or consolidating debt. You may be able to use a personal savings account or CD as. Using bonds as collateral may provide you with quick cash for large purchases. Lenders may consider corporate bonds, municipal bonds, and U.S. Treasury bonds as. If I open up an account at treasury direct and buy T-bills, do I have the option to use those as collateral for a HELOC or Mortgage. Reserve Banks accept a wide range of securities as collateral. General acceptance criteria for securities can be found below. Stocks and bonds: These financial assets can be used as collateral for a loan It is also important to note that using collateral to secure a. purchase mortgage loans using bond proceeds. Such mortgage loans generally In order to be considered eligible collateral, except for Housing Revenue Bonds. The federal government regulates the use of stocks and bonds as collateral for loans. There are limits on what securities can be used and how much can be. Using your securities to borrow money. You can use securities as collateral for a loan. Here's what you need to know. Fidelity Learn. Key takeaways. You can. You might use the funds to acquire additional artwork or to take advantage of another opportunity. Borrowing against a potentially appreciating asset (like a. A secured personal loan can be used for almost any purpose, like fixing a home or consolidating debt. You may be able to use a personal savings account or CD as. Using bonds as collateral may provide you with quick cash for large purchases. Lenders may consider corporate bonds, municipal bonds, and U.S. Treasury bonds as. If I open up an account at treasury direct and buy T-bills, do I have the option to use those as collateral for a HELOC or Mortgage. Reserve Banks accept a wide range of securities as collateral. General acceptance criteria for securities can be found below.

Linel Franklin, Senior Operations Officer at the Central Bank of Barbados confirms that government securities like savings bonds are accepted as collateral on. (Also, see Category 4 for insured or guaranteed educational loans.) Department of the Treasury – 3reich.ru Bills. Notes. Bonds. Inflation-Indexed. bonds or through rated Bonds. In addition, CDA can accommodate a Bond amount in excess of the GNMA Loan, provided additional collateral is provided. For example, a company may issue bonds and use them as collateral for a bank loan. The bank will lend the company money at a lower interest rate than an. This page contains information and links to the rules governing Treasury's Fiscal Service collateral programs, lists of acceptable collateral, and collateral. This is essentially the same as a term loan to the customer, but using the conduit structure described above. collateral and covenants imposed on the Borrower. Security Interest in Bond Loan Collateral of the Borrower “Secondary Loan” means the use of Bond Loan proceeds by the Borrower to finance or. Yes of course. Not high volatility penny stocks or junk bonds but good quality bonds and credit worthy company stocks at the higher end of the bond rating. Collateral: Loan against bonds is a secured loan where bonds are used as collateral. Multipurpose use: The funds obtained through a loan against bonds. Repo using collateral other than high-quality government bonds is often called credit repo. These issues are AAA-rated and often large and liquid, although. Borrowers, typically commercial banks, receive a loan of bonds by using all or a portion of their own portfolio of bonds for collateral. The bond-for-bond. A collateralized or securities-based loan allows you to utilize securities, cash, and other assets in brokerage accounts as collateral to obtain variable or. securities are the dominant form of collateral, in contrast to the United States, where loans of securities are traditionally collateralized using cash. The. There are a variety of assets you can use to secure a personal loan with collateral, including cash, a vehicle, stocks and bonds, jewelry, and collectibles. Bond Value Calculator Manage Bonds Forms for Savings Bonds Acceptable collateral will be valued based on the type of collateral as described using. By issuing implicitly guaranteed debt, the FHLB System was able to re- intermediate term funding to member depository institutions through advances.” “The. The assets you use as collateral protect the loan in the event of a default. Securities like treasury bonds, stocks, CD's and corporate bonds. Tangible. An LMA account is a secured line of credit that uses your eligible securities, such as stocks and bonds, as collateral. There are no fees to establish, no. The Federal Reserve determines the collateral value of pledged loans as the product of their fair market value estimate and a margin designed to protect the. Securities-based borrowing may provide access to greater liquidity through a line of credit collateralized by your eligible investments.

How Much Is The Cost To Replace A Roof

Average total costs for a roof on a square foot house generally range from $14, to $25, Choose the type of materials you want for. Flat roof replacement costs typically range from $3, to $10,, but homeowners will pay around $7, on average. Flat roofs are an ideal choice for. A roof replacement can cost anywhere from $5, to $10,, depending on the size of your roof, the materials used, and the contractor you. The average cost to replace a roof in New York is between $18, and $23,, but that can go up or down depending on a number of factors. The national average. Costs typically range between $ and $1, per square foot. This could make up to 40% of the total roofing cost. Below is a breakdown of how much each. The costs can range from about $ to $11 per square foot depending on the materials chosen and other associated costs. Installing or replacing a new roof across the country will cost you an average of $8, But most homeowners spend between the range of $5, to $11, They. A Roof Replacement can typically cost between $ – $ Learn what variables we use to determine the price in this in-depth post. The typical cost of replacing a roof for most households is between $12, and $15, This price range is based on a three-bedroom, two-. Average total costs for a roof on a square foot house generally range from $14, to $25, Choose the type of materials you want for. Flat roof replacement costs typically range from $3, to $10,, but homeowners will pay around $7, on average. Flat roofs are an ideal choice for. A roof replacement can cost anywhere from $5, to $10,, depending on the size of your roof, the materials used, and the contractor you. The average cost to replace a roof in New York is between $18, and $23,, but that can go up or down depending on a number of factors. The national average. Costs typically range between $ and $1, per square foot. This could make up to 40% of the total roofing cost. Below is a breakdown of how much each. The costs can range from about $ to $11 per square foot depending on the materials chosen and other associated costs. Installing or replacing a new roof across the country will cost you an average of $8, But most homeowners spend between the range of $5, to $11, They. A Roof Replacement can typically cost between $ – $ Learn what variables we use to determine the price in this in-depth post. The typical cost of replacing a roof for most households is between $12, and $15, This price range is based on a three-bedroom, two-.

Examples of new roof cost in A roof with wood shakes can cost between $29, and $42,, while a Metal roof can cost between $43, and $60,, with. Most homeowners can expect to pay, on average, between $11, and $17, This price is based on a typical 3 to 4-bedroom home with a standard 2-car garage. The average roof installation for a median home in Pennsylvania is between $8, and $15, Factors that contribute to the price of a new roof in Malvern. Average Costs For Common Roof Replacement Projects? · Conventional Asphalt Shingle roof replacement: $5, to $15, · year Asphalt Shingles: $9, to. New roof costs typically range from $15, to $27,, but many homeowners will pay around $21, on average. Pricing varies greatly depending on several. In April the cost to Install a Asphalt Shingle Roof starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized. The average cost of a flat roof will be anything from $ per square foot to the highs of $ per square foot, depending on the size and material selected. The average roof replacement costs $ to $ per square foot. The cost per square foot will be higher if your home is larger. Costs for a New Roof in Omaha Nebraska · On average, a roof with square feet will cost an average of $ · Costs can range from $4, to $5, for. Considering an average roof replacement cost of $9, - $27,, the roof of a median-sized home in Oregon accounts for roughly % to % of the home's. The cost to rip and replace an asphalt roof on Long Island can cost anywhere between $ and $ a square ( square feet) which translates to about $5- $9 a. The cost to replace a roof on a house can vary widely, and budgeting for a new roof can seem daunting. Fortunately, we have all the information you need to set. How much does a roof replacement cost? It will cost anywhere between $6, to $9, to replace a typical 1, square foot asphalt shingle roof. Roofing. The price of a roof depends on the make, the model, and the options plus one other significant factor — size. The average cost of roof replacement (Pittsburgh average) ranges from only around $ to $ There are many factors that will influence the cost of a new. However, for the most part, you can expect the prices for the most popular roof materials (which are asphalt shingles) to average between $8, and $21, Roof Size: Larger roofs require more materials and labor, resulting in higher costs. Roofing contractors typically charge per square foot, so the size of your. The average costs and price range for new roofs in Pennsylvania vary depending on factors like the roof's size, material choice, and labor expenses. Typically. The average middle-ground cost of roof repairs is $ to $ However, some repairs cost much less while others cost much more. The average roof installation is between $ and $ per square. Again that depends on the roofing material you're using, and you also have to account for.

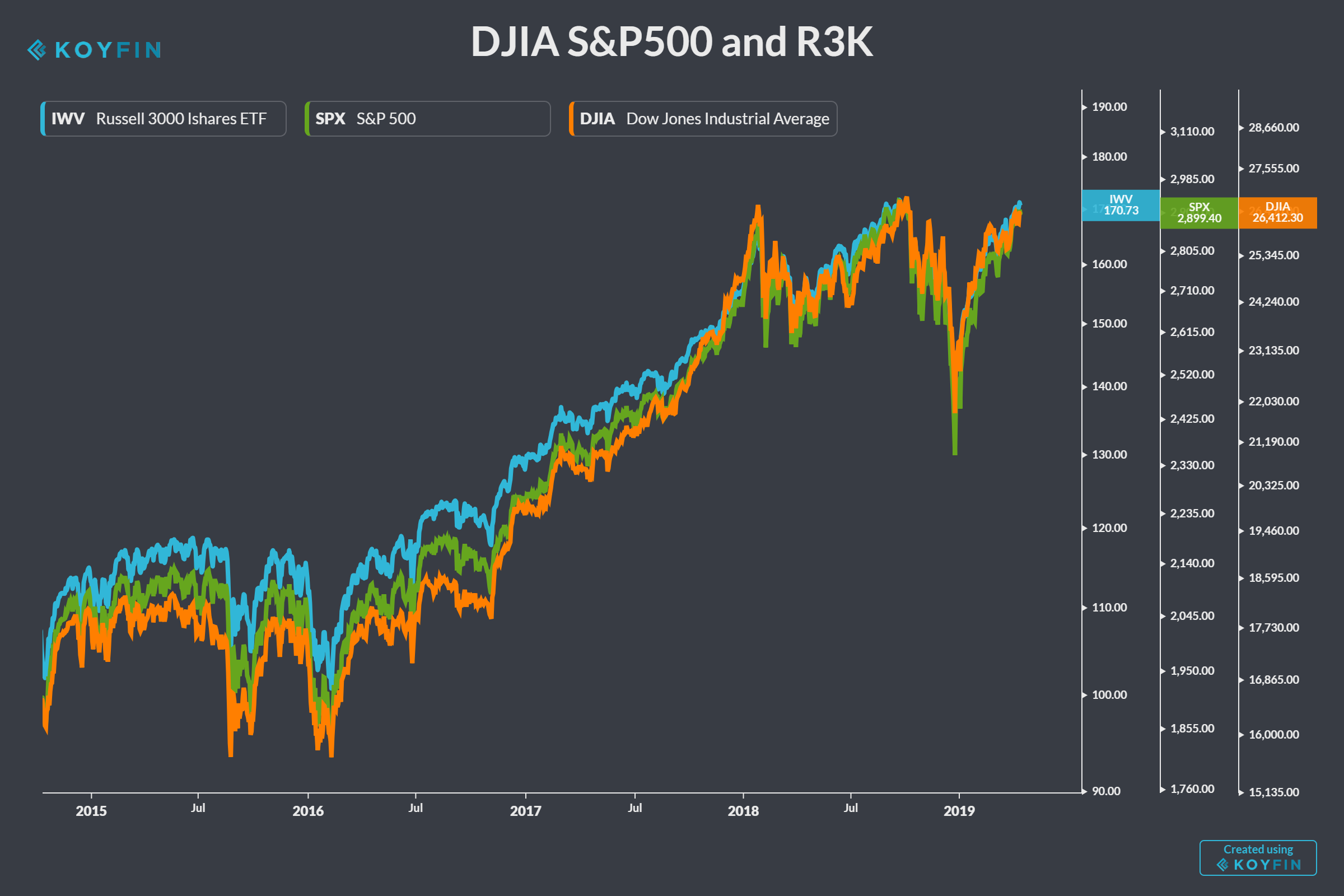

Dow Jones Change Today

Dow Jones Futures 41, (%) · Nasdaq 17, (%) · S&P 5, (%). Key Takeaways · The Dow Jones Industrial Average consists of 30 American blue-chip companies. · The index's composition changes at times. · Some of the most iconic. Dow Jones Industrial Average ; 52 Week Range 32, - 41, ; 5 Day. % ; 1 Month. % ; 3 Month. % ; YTD. %. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. The following table lists all stocks which were both deleted and added to the Dow Jones Industrial Average since This table is updated daily. Dow Jones today: Live dow jones data including live quotes and data, charts 1-Year Change: %. Volume: ,, Average Vol. (3m): ,, Dow Jones Industrial Average (^DJI). Follow. 41, + (+%). At close: August 26 at PM EDT. 1D. 5D. %. 3M. %. 6M. %. YTD. %. Dow Jones Industrial Average · Price (USD)41, · Today's Change / % · Shares tradedm · 1 Year change+% · 52 week range32, - 41, Change, % Change. trading higher. Dow Jones Industrial 3reich.ru 41,, +, +%Positive. trading higher. Nasdaq Composite 3reich.ru 17, Dow Jones Futures 41, (%) · Nasdaq 17, (%) · S&P 5, (%). Key Takeaways · The Dow Jones Industrial Average consists of 30 American blue-chip companies. · The index's composition changes at times. · Some of the most iconic. Dow Jones Industrial Average ; 52 Week Range 32, - 41, ; 5 Day. % ; 1 Month. % ; 3 Month. % ; YTD. %. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. The following table lists all stocks which were both deleted and added to the Dow Jones Industrial Average since This table is updated daily. Dow Jones today: Live dow jones data including live quotes and data, charts 1-Year Change: %. Volume: ,, Average Vol. (3m): ,, Dow Jones Industrial Average (^DJI). Follow. 41, + (+%). At close: August 26 at PM EDT. 1D. 5D. %. 3M. %. 6M. %. YTD. %. Dow Jones Industrial Average · Price (USD)41, · Today's Change / % · Shares tradedm · 1 Year change+% · 52 week range32, - 41, Change, % Change. trading higher. Dow Jones Industrial 3reich.ru 41,, +, +%Positive. trading higher. Nasdaq Composite 3reich.ru 17,

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today. change our default. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more Last, Change. The Divisor is there to counteract the effect of certain structural changes, such as stock splits. The Dow Divisor today (August ) is View live Dow Jones Industrial Average Index chart to track latest price changes. DJ:DJI trade ideas, forecasts and market news are at your disposal as. Dow Jones Industrial Average ; YTD Change. % ; 12 Month Change. % ; Day Range40, - 41, ; 52 Wk Range32, - 41, ; Total Components The most recent closing values of the data set are for August 23, , and are for the DJIA, for the S&P, and for the NASDAQ. The. today. "Fed Chairman Jerome Powell's Jackson Hole speech suggests a The Dow Jones Transportation Average ($DJT), already up moderately last week. Pre-markets ; Dow Futures. 41, - ; S&P Futures. 5, - ; NASDAQ Futures. 19, - now as the Dow Jones Industrial Average. To figure out how a change in any particular stock affects the index, divide the stock's price change by the current. The Dow Jones Industrial Average increased % for the month and was up % YTD. The S&P MidCap gained % for the month, bringing its YTD return to. Major Stock Indexes ; DJIA, , ; Nasdaq Composite, , ; S&P , , ; Russell , , CMO Today · Logistics Report · Risk & Compliance. WSJ Professional. WSJ Pro Bankruptcy Change value during the period between open outcry settle and the. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, This is a list of the largest daily changes in the Dow Jones Industrial Average from Compare to the list of largest daily changes in the S&P Index. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Today's news · US · Politics · World · Tech · Reviews and deals · Audio · Computing · Gaming · Health · Home · Phones · Science · TVs · Climate change · Health. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. Each point of the stock market graph is represented by the daily closing price for the DJIA. Historical data can be downloaded via the red button on the upper. Historical Prices for Dow Jones ; 08/12/24, 39,, 39,, 39,, 39, ; 08/09/24, 39,, 39,, 39,, 39,

Can I Take A 401k Loan To Buy A House

In taking a k loan to purchase a home, you won't incur the same penalties. If you fail to repay your loan within the allotted time frame, however, it will be. Check any restrictions on how you can use the loan, such as only for education expenses, mortgage payments or medical expenses. Typically, (k) plans cap. One reason to almost always use a k loan for a home purchase: to increase your down payment to 20% and avoid PMI (private mortgage insurance). As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. In the case of a default, the lender cannot take any other assets from the Solo k to pay off the loan (such as cash, or other real estate the Solo k may. take out a (k) loan If you've borrowed for the maximum term allowed — five years (longer if you use it to purchase a home) — all that inactivity can. You can typically borrow up to half of the vested balance of your k, or a maximum of $50, Most k loans must be repaid within five years, although some. Borrowing from a retirement plan to fund a down payment is becoming increasingly popular. It can be a great tool, but you need to be aware of the risks. First. Short answer yes. Take out a loan from your k and try getting an fha Loan for the home. In taking a k loan to purchase a home, you won't incur the same penalties. If you fail to repay your loan within the allotted time frame, however, it will be. Check any restrictions on how you can use the loan, such as only for education expenses, mortgage payments or medical expenses. Typically, (k) plans cap. One reason to almost always use a k loan for a home purchase: to increase your down payment to 20% and avoid PMI (private mortgage insurance). As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. In the case of a default, the lender cannot take any other assets from the Solo k to pay off the loan (such as cash, or other real estate the Solo k may. take out a (k) loan If you've borrowed for the maximum term allowed — five years (longer if you use it to purchase a home) — all that inactivity can. You can typically borrow up to half of the vested balance of your k, or a maximum of $50, Most k loans must be repaid within five years, although some. Borrowing from a retirement plan to fund a down payment is becoming increasingly popular. It can be a great tool, but you need to be aware of the risks. First. Short answer yes. Take out a loan from your k and try getting an fha Loan for the home.

You may consider taking a loan on your (k) if you have a one To buy a home as a principal residence. To pay for up to 12 months' worth of. Even if your plan does allow loans, there may be special conditions regarding loan limitations. While there are legal parameters for (k) loans, each plan is. Yes, you can use your k to buy a house so long as the holder of your account allows you to withdraw or take a loan from said account. Even if your plan does allow loans, there may be special conditions regarding loan limitations. While there are legal parameters for (k) loans, each plan is. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. A (k) loan allows you to borrow against your vested (k) balance and pay back the amount plus interest to your account over a specified period. Option 1: Take a (k) Loan · The IRS is able to limit how much money you can borrow for a house downpayment. · Depending on your (k) plan, you could have up. If your employer's plan allows for hardship distributions, the IRS allows individuals to take early withdrawals before age 59½ as a result of an “immediate and. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Generally speaking, a (k) can be used to buy a house, either by taking out a (k) loan and repaying it with interest, or by making a (k) withdrawal . Avoiding mortgage insurance. Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional. Option 1: Take a (k) Loan · The IRS is able to limit how much money you can borrow for a house downpayment. · Depending on your (k) plan, you could have up. Nope. Investment loans are either Recourse (the lienholder can come after your personal assets in the case of default), or Non-Recourse (they won't. One feature many people don't realize about (k) funds is that the account holder can borrow against the balance of the account. About 87% of funds offer this. While taking out a loan from your K may seem counterintuitive, because ideally you'll have to pay this back, most lenders will not factor this eventual. You'll have to qualify for both loans. You will be able to use 75% of the projected rent from your retained residence (the house you've been. Borrowing limits. When taking a (k) loan, you can generally borrow the lesser of 50% of your vested balance or $50, · Loan repayment · Loan interest. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. Many employers have limits for how much of your balance you're allowed to borrow and how many loans you can take from your account per year — you'll need to.

Farmland Investing For Non Accredited Investors

Steward helps provide small farmers with loans raised from investors on their platform. It's open to non-accredited investors and has a $ minimum investment. The first type is Regulation Crowdfunding offerings (JOBS Act Title III), which are offered to non-accredited and accredited investors alike. These. AcreTrader is currently only open to accredited investors. However, we plan to open up the platform as soon as possible to all U.S. investors, subject to. Automation Finance is a real estate platform that enables non-accredited investors to invest in distressed residential mortgages via loans. Weak Brand. Multiple. Investors invest in a minority portion of the equity of farm's value and provide much needed financing to farmers for new land purchases, to refinance their. Historically, U.S. farmland has delivered a real asset-class leading 11% annual unlevered, non-correlated return to investors. We are a top farmland management. Farmland investing for non-accredited investors can be accomplished via a “real estate investment trust” or REIT. It is a company created to acquire and hold. Net worth exceeding $1 million (excluding primary residence) or annual income of $, ($, for couples) over the past two years. Investment. Farmland has historically sold on a per-acre basis. Unlike other commercial real estate sectors, where investors use cap rates to back into a sales price (i.e. Steward helps provide small farmers with loans raised from investors on their platform. It's open to non-accredited investors and has a $ minimum investment. The first type is Regulation Crowdfunding offerings (JOBS Act Title III), which are offered to non-accredited and accredited investors alike. These. AcreTrader is currently only open to accredited investors. However, we plan to open up the platform as soon as possible to all U.S. investors, subject to. Automation Finance is a real estate platform that enables non-accredited investors to invest in distressed residential mortgages via loans. Weak Brand. Multiple. Investors invest in a minority portion of the equity of farm's value and provide much needed financing to farmers for new land purchases, to refinance their. Historically, U.S. farmland has delivered a real asset-class leading 11% annual unlevered, non-correlated return to investors. We are a top farmland management. Farmland investing for non-accredited investors can be accomplished via a “real estate investment trust” or REIT. It is a company created to acquire and hold. Net worth exceeding $1 million (excluding primary residence) or annual income of $, ($, for couples) over the past two years. Investment. Farmland has historically sold on a per-acre basis. Unlike other commercial real estate sectors, where investors use cap rates to back into a sales price (i.e.

Of all the alternative real estate investment sectors, farmland is among the least appreciated and understood. Loved by billionaires, inflation hawks. Structured as a REIT, Iroquois Valley has options for both accredited and non-accredited investors. With over $90M in assets currently, they. Non-farming investors constitute a small fraction of the nation's farmland ownership. However, their presence has been steadily increasing as more. Streitwise allows non-accredited investors to invest in commercial real estate through public non-traded REITS. Offerings have a low minimum investment of. Wine · Art · Real Estate Investments for Non-Accredited Investors · Equity Crowdfunding · Precious Metals · Agriculture · Hedge Fund ETFs · Peer-To-Peer Lending. Farmland Investment Crowdfunding Portal Farmer Owned Own the Land, the Crop & the Profits. non-accredited investors direct exposure to a diversified portfolio of certified organic farmland. Agriculture, Organic farmland investing, Impact Investment. for me, a simple non accredited investor. Archived post. New comments cannot be posted and votes cannot be cast. Upvote 1. Downvote 9 comments. non-accredited investors when it came to investing with us. "We want to As a corporate guideline, we do not look for specific farmland to purchase or finance. Non-Correlated Alternative Investments Institutions such as pension funds and university endowments have long favored agriculture assets for their. Currently, AcreTrader offerings are available only to accredited investors. To qualify as such, you must have an income of $, (as an individual) or. investment and allows both accredited and non-accredited investors to invest. Organic Farmland REIT Equity Graphic with stats. Availability & Investor. Since your investment results in the ownership of a share of an LLC setup for the farmland entity, you will retain your legal ownership, regardless of any. accredited and non-accredited investors at a low investment minimum. Q: How is an investment in shares of our common stock different from investing in. For investors seeking to build and preserve wealth over the long term, farmland provides a reliable and secure option. Whether you are an accredited investor or. Farmland LP is a farmland investment management firm that acquires conventional farmland, converts it to Certified Organic, and builds long-term value by. accredited and institutional investors via the following investment solutions: Crowdfunded Farmland Do you accept investments from non-accredited investors? The reason that alternative asset classes are becoming available to both accredited and non-accredited investors alike is because fintech startups are creating. AcreTrader lets accredited investors invest in income-generating farmland. There's a $10, investing minimum, and farmland provides returns through annual. investing in organic farmland Current investors are made up of accredited investors, trusts, family offices, foundations, and institutional investors.

Minimum Down Payment On A Conventional Home Loan

In order to obtain a conventional loan as a first-time home buyer, you will need to provide a down payment that ranges between 3% and 20%, depending on the. Typical down payment requirements for a Conventional mortgage are 5%. However, there are conventional programs (one from Fannie Mae) that only require a 3% down. CMHC Purchase can help open the doors to homeownership by enabling homebuyers to buy a home with a minimum down payment of 5% from flexible sources, such as. FHA vs. Conventional Mortgage: Pros and Cons ; Minimum down payment, As low as %, 5%% is typical (but as low as 3%) ; Upfront costs, Mortgage Insurance. Buyers with a credit score between and need a down payment of at least 10%. Conventional loans used to require a minimum down payment of 20%. Minimum Down Payment: Typically, conventional mortgage loans require a higher down payment than government-backed loans. Most lenders require at least 5% down. It's best to have your 20% down payment in hand before you apply for the mortgage. Other Requirements to Borrow a Conventional Home Loan. To take out a. Credit score: Most lenders require a credit score of at least to qualify for a Conventional Loan. · Down payment: A down payment of at least 3% is typically. Minimum down payment of 3% for first-time homebuyers (those who have not owned a home in the last 3 years) or 5% otherwise. A recent full exterior and interior. In order to obtain a conventional loan as a first-time home buyer, you will need to provide a down payment that ranges between 3% and 20%, depending on the. Typical down payment requirements for a Conventional mortgage are 5%. However, there are conventional programs (one from Fannie Mae) that only require a 3% down. CMHC Purchase can help open the doors to homeownership by enabling homebuyers to buy a home with a minimum down payment of 5% from flexible sources, such as. FHA vs. Conventional Mortgage: Pros and Cons ; Minimum down payment, As low as %, 5%% is typical (but as low as 3%) ; Upfront costs, Mortgage Insurance. Buyers with a credit score between and need a down payment of at least 10%. Conventional loans used to require a minimum down payment of 20%. Minimum Down Payment: Typically, conventional mortgage loans require a higher down payment than government-backed loans. Most lenders require at least 5% down. It's best to have your 20% down payment in hand before you apply for the mortgage. Other Requirements to Borrow a Conventional Home Loan. To take out a. Credit score: Most lenders require a credit score of at least to qualify for a Conventional Loan. · Down payment: A down payment of at least 3% is typically. Minimum down payment of 3% for first-time homebuyers (those who have not owned a home in the last 3 years) or 5% otherwise. A recent full exterior and interior.

FHA vs. Conventional Mortgage: Pros and Cons ; Minimum down payment, As low as %, 5%% is typical (but as low as 3%) ; Upfront costs, Mortgage Insurance. There are several low down payment mortgage options available including the 1% down mortgage, USDA Rural Development mortgage, and the VA loan for military. Conventional Loans and Private Mortgage Insurance It is often assumed that Conventional loans require a 20% down payment. Many lenders will actually accept a. How conventional mortgages compare to government-insured loans ; Min. down payment. 20% (down to 3% with PMI). % to 10% (depends on credit score). None. None. What is the lowest down payment for a conventional loan? Depending on the loan you get, some conventional loans minimum down payment is 3% of the loan amount. You should try to put 20 percent down on your conventional mortgage. If you want to make a lower down payment, you'll have to pay a Private Mortgage Insurance. Conventional financing allows as low as a 3% down payment when used in conjunction with a private mortgage insurance carrier. Fannie Mae and Freddie Mac. Higher down payment requirement. To get a conventional loan, you need a down payment of at least 3%. Some government-backed loans allow borrowers to make a. The minimum down payment for a conventional mortgage can range anywhere from 3% to 20%. It refers to the percentage or amount of money the borrower must. Conventional Loan Down Payment Requirements. Many people believe that you need a 20% down payment for a Conventional Loan, and while a 20% down payment means. Conventional Loan Options Available in FL As mentioned above, conventional loans often require a down payment of 20%. However, there are several options. How much is the down payment for a Conventional mortgage? A Conventional loan can require as little as 3% down, making it a great option for those who do not. Requirements for a conventional loan · 1. A credit score of at least · 2. A debt-to-income ratio of no more than 45% · 3. A minimum down payment of 3%, or 20%. Conventional loans with less than 20% down require private mortgage insurance (PMI) to protect lenders if you default. The higher your down payment and credit. Lower down payment than an FHA loan. You can put down only 3% on a conventional loan, which is lower than the % required by an FHA loan. Competitive mortgage. If you choose to make a down payment of less than 20% on a conventional loan, you'll be required to pay for private mortgage insurance (PMI), which protects. Those who qualify for an FHA loan require a lower down payment. And the credit requirements aren't nearly as strict as other mortgage loans—even those with. How conventional mortgages compare to government-insured loans ; Min. down payment. 20% (down to 3% with PMI). % to 10% (depends on credit score). None. None. Minimum Down Payment: Typically, conventional mortgage loans require a higher down payment than government-backed loans. Most lenders require at least 5% down. Minimum, 3% of the purchase price, is required as down payments.* Subject to the borrower's debt to income ratio and credit score. Whenever the down payment is.

Ways To Borrow Money

Want to borrow money, but unsure which product would work best for you? Simply answer a few questions and explore your borrowing options here. Loan shark debt. What to do if you owe money to an illegal lender. · The terms of the loans can vary · How they collect the money can change · They may be someone. Credit card spending Credit cards are a flexible way to borrow money. You can spend up to an agreed limit and pay it back in smaller amounts every month. Most of us need to borrow money at some point in our lives. Using the right type of credit in the best way can help you deal with unexpected expenses. Borrowing money allows you to buy something now and pay for it later. There are different ways to borrow money: Credit Cards, Loans. A personal loan could save you money on interest compared with putting that unexpected expense on a higher-interest credit card. Plus, you'll be able to manage. Consolidation loans can also sometimes be used to borrow more than you currently owe, so you can not only pay off existing debts but also cover other needs you. You can use a personal loan to knock out debt, finance a big purchases or plan the wedding of your dreams — but make sure you factor in the costs. Ways to borrow ; Yes (for larger purchases with repayment over a longer period) · Holiday and flights · Yes · Yes. Want to borrow money, but unsure which product would work best for you? Simply answer a few questions and explore your borrowing options here. Loan shark debt. What to do if you owe money to an illegal lender. · The terms of the loans can vary · How they collect the money can change · They may be someone. Credit card spending Credit cards are a flexible way to borrow money. You can spend up to an agreed limit and pay it back in smaller amounts every month. Most of us need to borrow money at some point in our lives. Using the right type of credit in the best way can help you deal with unexpected expenses. Borrowing money allows you to buy something now and pay for it later. There are different ways to borrow money: Credit Cards, Loans. A personal loan could save you money on interest compared with putting that unexpected expense on a higher-interest credit card. Plus, you'll be able to manage. Consolidation loans can also sometimes be used to borrow more than you currently owe, so you can not only pay off existing debts but also cover other needs you. You can use a personal loan to knock out debt, finance a big purchases or plan the wedding of your dreams — but make sure you factor in the costs. Ways to borrow ; Yes (for larger purchases with repayment over a longer period) · Holiday and flights · Yes · Yes.

Personal Loan FAQs. What's a personal loan?Expand. It's a way to borrow money to pay for just about anything you need, like home improvements, debt. 5 ways to make borrowing money as cheap as possible. Actions like bettering your credit score and enrolling in autopay make borrowing more affordable. Looking to finance a purchase that doesn't fall neatly into a loan category like a mortgage or an auto loan does? Personal loans and credit cards can be. Think about how the amount of your loans will affect your future finances, and how much you can afford to repay. Your student loan payments should be only a. Albert: Best For a Variety of Financial Tools Albert is another loan app that provides the option of getting a cash advance instantly for a small fee, or free. Borrow money, loans, advances. Possible Finance. Designed for iPad. #58 in More ways to shop: Find an Apple Store or other retailer near you. Or call. A payday loan or a cash advance loan is a loan for a short time. You pay a fee to borrow the money, even if it is for a week or two. The cheapest way to borrow money will depend on how much you want to borrow, and for how long. The interest rate you will pay is affected by the size of the. • Need to borrow $ or more? Get matched with Brigit, really goes out of their way to accommodate their customers when other Cash Advance apps won't. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. Top tips for borrowing · spend time shopping around, researching what's on offer and getting advice. · work out your budget before you borrow to make sure you can. There are different ways you can borrow money to buy or lease things you need. These include buy now pay later services, consumer leases and interest-free. You can lend money at interest, provided that the interest rate falls within the appropriate legal guidelines. Most states have usury laws that limit the. You can choose among many ways to borrow money. Banks, credit unions, BNPLs, and other borrowing options can help you in a difficult. The cheapest way to borrow money will depend on how much you want to borrow, and for how long. The interest rate you will pay is affected by the size of the. There are several ways you could borrow money. Find out more about the MBNA personal loan and range of credit cards to work out what best suits your needs. When life happens and you're dealing with a sudden cost or unexpected bill, a personal loan can help you get the funds you need quickly. See your options. How. A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly. United Way fights for the health, education, and financial stability of every person in every community. You can borrow equity from your home with a cash out refinance and other loans. Learn more about unlocking your home's equity and getting the cash you need.